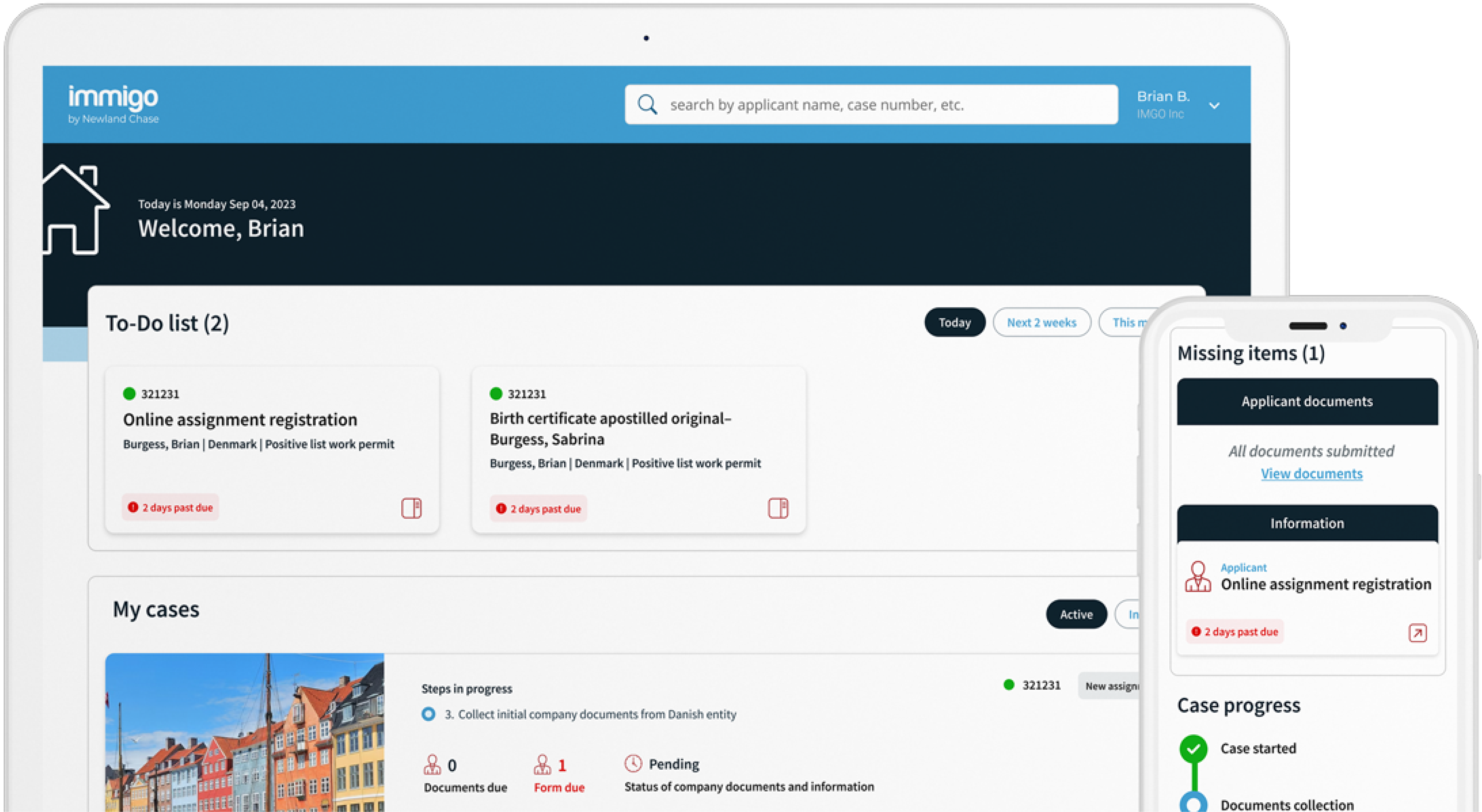

Get The Visibility Your Company Needs

Reduce compliance risks and mobility costs while managing individual and project-related travel with ImmiSMART: the solution that unifies your travel and mobility programs.

AUSTRALIA: TSMIT Review & Data Matching Programme

October 30, 2015

TSMIT Review

Under an agreement with the Opposition Labor Party on the China-Australia Free Trade Agreement (ChAFTA) the Government has undertaken to review the TSMIT (Temporary Skilled Migration Income Threshold). It has remained at $53,900 since 2013.

457 visa holders must be paid at the Australian market salary rate which varies depending on the occupation and location of the role. At the same time, occupations with a market salary below the TSMIT are not eligible to be sponsored under the subclass 457 visa programme, even if the salary offered by the employer is higher than the TSMIT.

The review is to be undertaken before the end of the year. It will consider the current TSMIT level, determine if it should be indexed and, if so, the best methodology for doing so. Peak business groups, the Australian Council of Trade Unions (ACTU) and other relevant stakeholders will be consulted as part of this process. Under the former Labor Government, TSMIT was indexed annually in line with wages growth.

Read the joint media release from The Hon Peter Dutton MP, Minister for Immigration and Border Protection and The Hon Andrew Robb AO MP, Minister for Trade and Investment here.

ATO and DIBP Data Matching Programme

A notice of the Australian Taxation Office (ATO) and the Department of Immigration and Border Protection (DIBP) Data Matching Programme was gazetted on 21st October 2015. Through this data matching programme the ATO will acquire details of visa holders, their sponsors, and migration agents for the 2013-14, 2014-15, 2015-16 and 2016-17 financial years from DIBP. It is estimated that records relating to approximately 1,000,000 individuals will be obtained.

According to the ATO, the programme “has been developed to assist the ATO to effectively detect and deal with compliance risks within the visa holding population” and ensure that individuals and organisations are meeting their taxation obligations, including their registration, lodgment, reporting and payment responsibilities.

Where sponsors are found to have not met their obligations they may be subject to significant fines and sanctions, including cancellation of their sponsorship approval and a bar from future sponsorship approval.

It is very important to ensure your business maintains its compliance with its sponsorship obligations. Please ensure your payroll records are up-to-date and accurate, that your 457 visa holder employee”s earnings are consistent with the information that has been provided to Immigration and that DIBP has been notified of any changes to the employment status or conditions of your 457 visa holder employees.

Read the Gazette Notice here and more information on the programme from the ATO here.

Should you have any questions about how the TSMIT review or data sharing programme may affect your business and employees, please do not hesitate to contact us for further information.