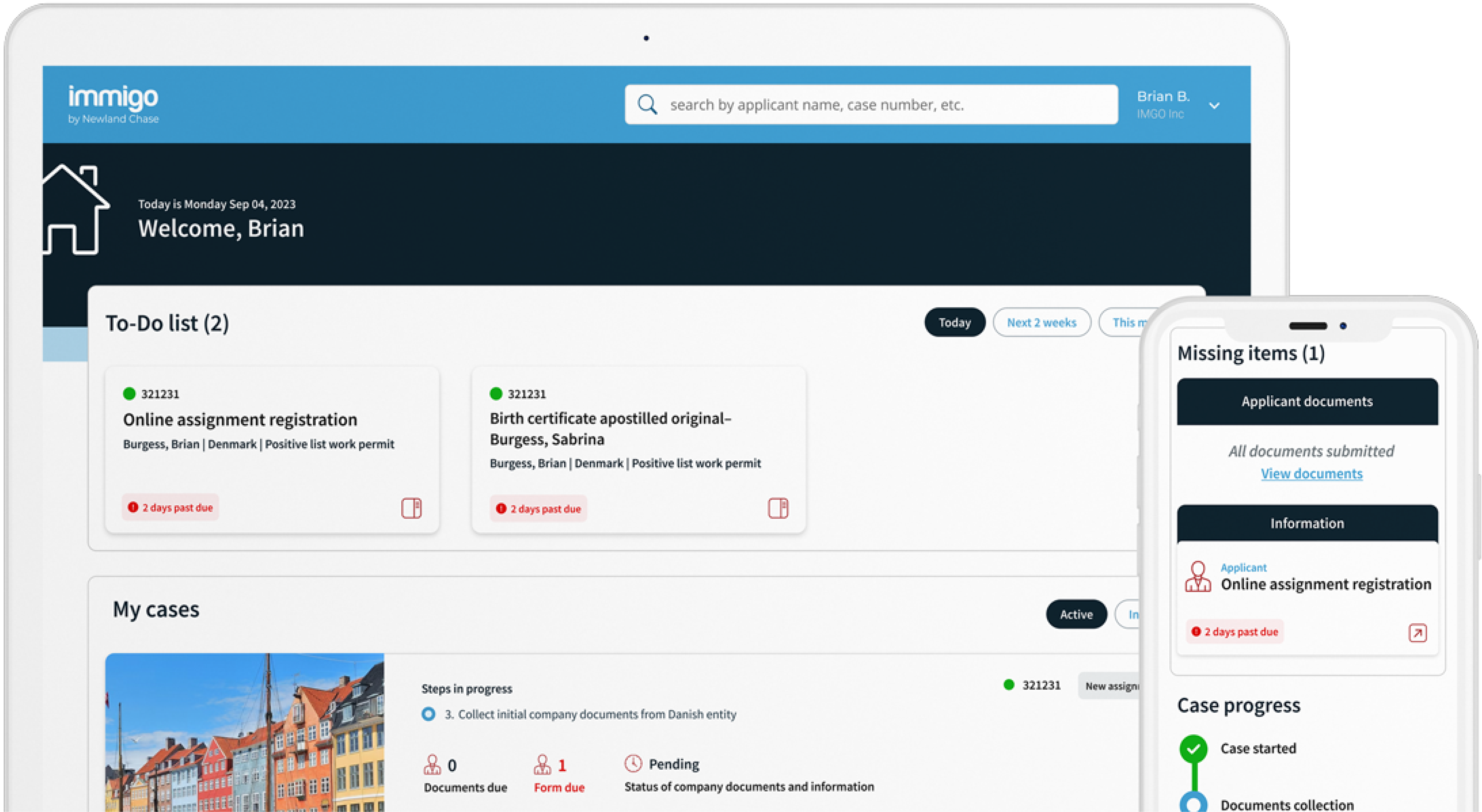

Get The Visibility Your Company Needs

Reduce compliance risks and mobility costs while managing individual and project-related travel with ImmiSMART: the solution that unifies your travel and mobility programs.

Managing Remote Talent: Cross-Border Compliance & Risk Management

December 1, 2023

Office walls progressively dissolved in the 21st century, and now, thanks to the Internet and technology, many of us can work from anywhere. But this new way of working comes with problems, especially concerning laws and rules from different countries. Issues like immigration, taxes, and navigating all of the various regulations can be tricky.

In this article, two of our senior experts, Manpreet Dhami-Magne, Chief Strategy Officer, and Ray Rackham, Senior Vice President of Thought Leadership, Advocacy, and Public Policy, offer insights into how to build remote-friendly teams while adhering to the necessary international rules, regulations, and protocols.

Where did the concept of remote work begin?

RR: The concept of remote working, though not necessarily crossing borders to do so, dates back to decades into the last century. In 1973, NASA engineer Jack Niles laid the foundation for remote working by coining the phrase ‘telecommunicating’ as a means to operate outside of the usual constraints of an office environment, and by 1983, IBM had more than 2,000 employees working outside of the office space.

In 1997, Tsugio Makimoto and David Manners’ book Digital Nomad foretold how the current and future technological possibilities, combined with our natural urge to travel, would enable humankind to live, work, and exist across geographies. Indeed, a healthy ‘nomad’ or ‘remote’ population of working travelers has existed (particularly across South East Asia) for many years.

The technological advances of digital platforming, digital conferencing, and the cloud diminished physical constraints, and the technological opportunities thrived.

In many cases, though, the immigration rules of a country had not caught up. So many individuals operated in the gray area between the strict letter of the immigration rule and the country’s appetite to enforce it.

How did the pandemic accelerate the trend towards remote work?

RR: The pandemic shifted a lot of human behaviors, particularly in those who had experience working on assignments in a pre-COVID world. There was a significant amount of discourse surrounding the concept of ‘remote assignments’ in the early days of the pandemic, and this led to a conceptual rethink of what it meant to work from anywhere, which continues to impact today’s remote working debate.

As the world reopened, it became apparent that the philosophical question around nomad visas had picked up steam. The rise of digital nomad visas, almost worldwide, reflects the changing nature and the future of work in the post-pandemic world.

Countries are undoubtedly making it easier for remote workers to live and work from an immigration perspective. Remote work has also become more attractive as a conceptual global talent tool, promoting flexibility and inclusivity as foundations within immigration policy.

What are the main challenges or obstacles to remote work today?

RR: Immigration permissibility is only one side of the compliance coin, and the remote talent/digital nomad debate shines a light on how the relaxation of one element of cross-border compliance (in this case, immigration rules) can lead to unintended and significant consequences for both the individual and the employer, including the more obvious tax and social security compliance but also other associated labor laws, non-discrimination legislation, intellectual property, and data privacy.

MDM: Lack of clarity on immigration legislation permitting remote work, specifically in locations where the employer does not have an established entity, is a real challenge. Many governments allude to having digital nomad and/or other remote working routes to attract talent.

Still, the reality is that, in many cases, the actual processes for applying for such immigration routes remain obscure. Government departments are often unclear on how to use the legislation in practice (and therefore can neither guide the employee nor the employer).

In places where remote working is straightforward from an immigration perspective, potential tax obstacles may arise for individual employees and employers. Onboarding, culture, productivity, and duty of care create additional risks. Many companies do not factor in the time and cost of managing remote talent.

What are the benefits of remote work?

RR: A remote work/cross-border program promotes better work-life balance, the opportunity for employees to experience new cultures, and the ability to explore the world while employed and developing their careers in a genuinely programmatic approach.

Many employers struggle with remote work’s challenges and benefits. Still, they ensure the many benefits of cross-border remote working do not expose the employer or employee to disproportionate compliance risks by employing ongoing programmatic strategies.

Remote working compliance can open the world to many of the significantly positive associated elements of remote working, empowering employees to strike a nuanced work-life balance and experience cultures and parts of the world that, pre-pandemic, might not have been readily available. As the world continues to shift its axis to accommodate remote cross-border work in immigration legislation, having a team of experts who understand the changing dynamism in this space is the perfect blend.

What are the top compliance issues employers must be aware of when hiring or managing remote talent?

RR: Any relocation creates pockets of stress or concern for both an employee and the employer. The relatively new nature of cross-border remote working further complicates an already complicated matter. As with any process, simplification and consistency are paramount, but it’s also essential to understand how this type of relocation works, what the typical things to be conscious of are, and how to find pathways for associated and ancillary compliance obligations.

How can companies remain compliant when introducing remote work?

RR: Immigration and visa requirements will almost always come first. Program managers should ensure that there are legal pathways to confirm the right to work and double-check immigration rules and procedures when determining pre-relocation feasibility.

In many cases, unknowingly allowing for breaches of immigration rules can have as significant an impact as simply ignoring them, so employers should look to have clear and accurate information.

Employers must keep updated with the changing landscape as countries change immigration rules to attract this talented population. Being aware of local employment and labor laws, and how remote or nomad workers fit into that specific compliance jigsaw, is critical.

MDM: Immigration, tax, and general HR policies must be fit to manage and support remote talent without creating issues, such as claims of discrimination, inequality, and inclusion, or digital risks, such as connectivity, insufficient or restricted access for remote tools and tasks, IT security and protection, and resource monitoring.

Where do remote workers pay taxes?

RR: Once company leadership accounts for the immigration issue, the next step is thoroughly understanding how international taxation works for each market. Physical residency and tax residency are not always the same. Employment taxation and corporate tax exposure can get very complicated very quickly.

Corporate tax obligations and permanent residence considerations are often triggered for various reasons beyond simply having a physical presence in a country. They can include the portion of sales revenues being made in the country visited and the cross-border remote worker’s ability to make strategic company decisions in the visited country.

How does Newland Chase help companies manage compliance and risk when hiring foreign talent?

MDM: A compliant and programmatic response to the emerging and growing trend of remote work will enable employers to robustly manage the many compliance pitfalls that present themselves in the world of cross-border remote and nomad working.

Immigration considerations are often the gateway to broader debates, and immigration is the perfect place to start. Our world-leading Advisory Team not only supports our clients in determining immigration feasibility, but goes beyond that by helping clients cultivate policy frameworks that get to the heart of cross-border issues and giving practical immigration strategies, which provide the starting point for a broader compliance strategy that looks to build new talent strategies aligned to risk appetite.

The Newland Chase Advisory Team can support companies with robust policies to support all aspects of remote work and cross-border compliance, including dispelling the mystery around available and practical immigration routes, highlighting potential risks, and establishing a robust strategy.

Partnering for success: Managing compliance with Newland Chase

The juxtaposition of expanding technological horizons and the complex web of international compliance reveals the need for meticulous foresight and strategic navigation. But in this transformative era, businesses cannot afford to tread lightly or mindlessly.

We’ve covered immigration and visa considerations, tax liabilities, HR and employment challenges, and compliance and risk management, but that just scratches the surface. Other important considerations include cultural adoption, insurance and liability, digital security and cyber threats, infrastructure, health and well-being, performance monitoring, and emergency response.

Lean on experts like Newland Chase to ensure remote programs are compliant and teams are poised to harness the full potential of global remote talent. Equip your organization with the strategic depth and guidance Newland Chase offers and, in doing so, pioneer a new era for remote work and cross-border compliance. Contact us to learn more.