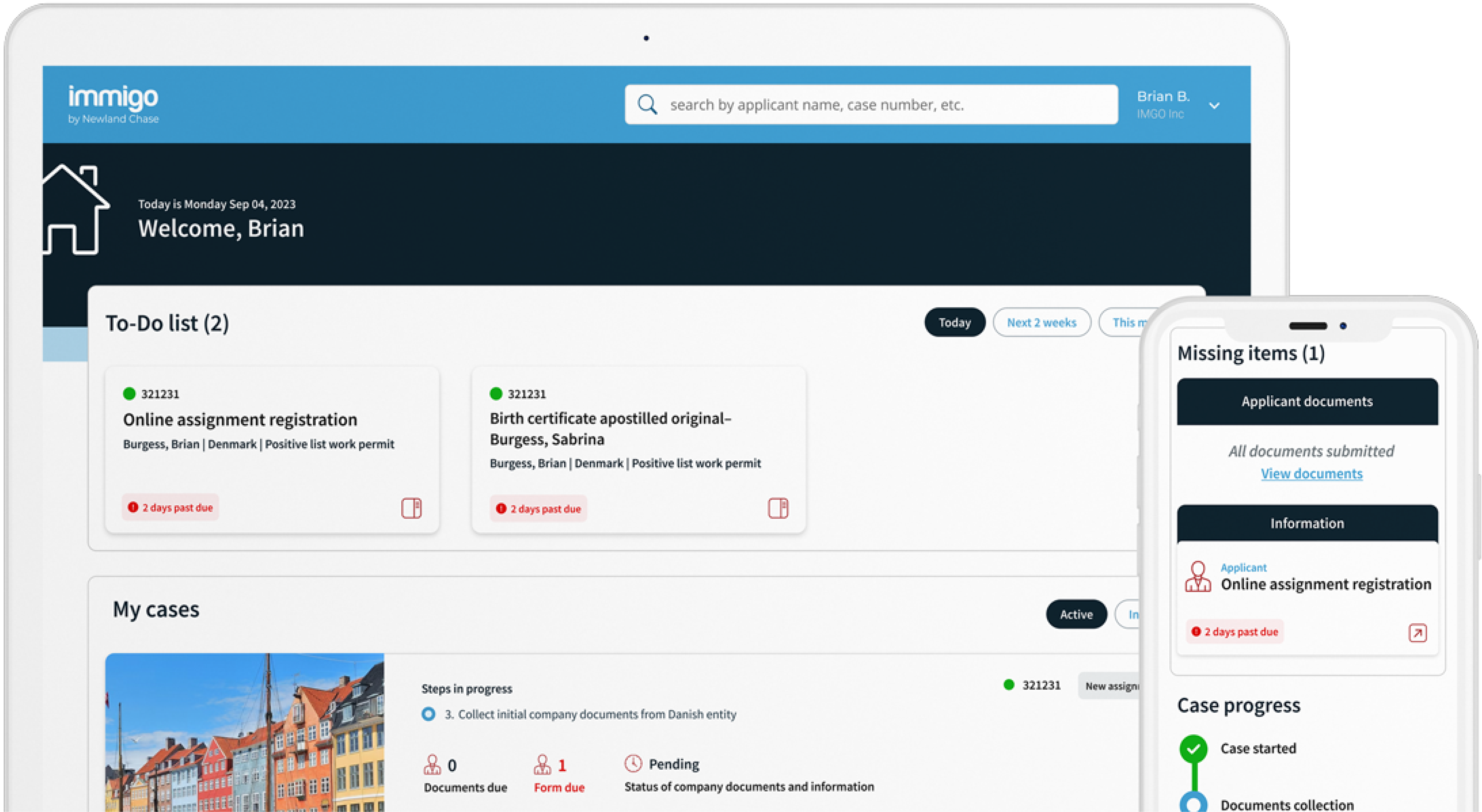

Get The Visibility Your Company Needs

Reduce compliance risks and mobility costs while managing individual and project-related travel with ImmiSMART: the solution that unifies your travel and mobility programs.

Top 10 Global Immigration Updates | Week of 11 January 2021

January 15, 2021

CHINA: Companies Must Re-verify Work Permit System Accounts

From 11 January 2021, companies registered with the work permit system must verify their accounts on the new government service platform before they can re-log into the system to apply for, extend or cancel work permits for foreign nationals as usual.

Companies are advised to complete the verification as soon as possible to avoid missing deadlines. However, the new system may take some time to stabilize. Please contact Newland Chase for assistance with the re-registration process.

DENMARK: New Salary Rules, Government Fees, Positive Lists

Denmark has increased the minimum salary for the Pay Limit Scheme for 2021 from DKK 436,000 to DKK 445,000 per year. The increase does not apply to pending or renewal applications, as long as the job has not changed.

Please note that all salary paid to foreign nationals on one of the work schemes in Denmark must now be paid to the assignee’s Danish bank account.

Government residence permit fees for work are increased for 2021 from DKK 3215 to DKK 4295 for the principal applicant and from DKK 1470 to DKK 1680 for dependent family members.

Finally, the Positive Lists have been updated for 2021. The Positive Lists are Denmark’s lists of occupations which are currently experiencing a shortage of qualified professional resident workers.

FRANCE: 2021 National Minimum Salary Published

Effective 1 January 2021, the French government has increased the minimum legal monthly salary requirement (SMIC) to EUR 18,655 per year

The SMIC is the minimum legal salary for all workers in France. A change to the SMIC affects minimum salary thresholds for some types of work permit:

- Passeport Talent – Salarié En Mission: EUR 33,579;

- Passeport Talent – Salarié Qualifié: EUR 37,310;

There is no change to the salary threshold for the “EU Blue Card” version of the Passeport Talent, as this is not calculated according to the SMIC.

The SMIC increases every year in France. It is fixed as an hourly rate, with the monthly rate calculated assuming a 35-hour week (which is the general working week in France, although this may vary).

Note that salary specifications of the French company’s bargaining agreement also have to be taken into consideration.

GERMANY: British Citizens Treated as Privileged Nationals

Effective 1 January 2021, the German government has included UK nationals who are not covered by the Withdrawal Agreement in the category of privileged nationals for employment purposes under Section 26, Paragraph 1 of the Employment Regulations (alongside nationals of Australia, Canada, Israel, Japan, New Zealand, South Korea and the United States).

This allows additional immigration options for UK nationals, including a residence permit for work which allows local employment in Germany by a German employer and assignment to a German entity (including assignment directly to a German client or customer).

LUXEMBOURG: 2021 National Minimum Salary Published

On 1 January 2021, minimum salary levels increased in Luxembourg for non-graduate workers and other qualified workers.

- For non-graduate workers, including Work Permit for Salaries Workers applicants, the new minimum wage is EUR 2201.93 gross per month.

- The minimum wage for qualified workers is now EUR 2642.32 gross per month.

The minimum wage increase applies to EU/EEA and Swiss nationals, along with EU Intracompany Transferee (ICT) Permit applicants and graduate applicants for a Work Permit for Salaried Workers. A separate threshold applies to EU Blue Card applicants.

The minimum salary requirements apply to existing permit holders along with new and pending applications as of 1 January 2021. Additionally, EU ICT Permit holders must be compensated at the same rate as a local worker in the same position if that wage is higher.

Benefits and allowances may count toward the minimum wage if they are specified in the employment contract or assignment letter, processed through a payroll, not paid in kind, paid at regular intervals during the employee’s assignment, and fixed and guaranteed. Performance-based bonuses do not qualify.

Employers must pay their workers in EUR regardless of exchange rate fluctuations and payroll location.

ROMANIA: New Minimum Salary for 2021

Effective 1 January 2021, the minimum gross monthly salary is increased from RON 2230 to RON 2300.

This affects employees occupying positions that do not require university studies, and do not have at least one year working experience, as well as their dependents. This includes foreign workers, including standard employees, assignees and EU ICT transferees.

For employees occupying positions that do require university studies, as well as at least one year working experience in positions that require university studies, the minimum gross salary will remain RON 2350 per month.

Highly skilled workers must be paid twice the medium gross salary, which is now RON 5429 x2 = RON 10,858.

The required means of support for family members is the minimum gross salary for each family member.

RUSSIA: HQS Salary Notifications to be Submitted by 29 January 2021

Employers of foreign nationals in Russia must submit quarterly notifications on the salary paid to highly-qualified specialist (HQS) employees in the 4th quarter of 2020 by 29 January 2021.

Effective 1 January 2021 the new forms approved by the order of the MIA of Russia dated 30.07.2020 No.536 must be used for the notification process.

The reported salary amount should be no less than the minimum level set for HQS employees (standard conditions):

- 167,000 RUB per one calendar month;

- 501,000 RUB per one quarter – if there was a break in work during the reported period.

Payments included in salary in accordance with clause 1, article 129 of the Russian Labour Code should be included in the notification form.

Non-notification or violation of the established notification form or procedure leads to administrative fines imposed on employers:

- officials – from 35,000 RUB to 70,000 RUB;

- legal entities – from 400,000 RUB to 1,000,000 RUB.

Failure to pay the salary in the minimum amount set for HQS:

- a ban on the company employing new HQS employees for two years.

QATAR: All Borders with Bahrain, Egypt, Saudi Arabia and UAE Agree to Reopen Borders

Bahrain, Egypt, Saudi Arabia and the United Arab Emirates have lifted their boycott against Qatar after three and a half years and agreed to restore full diplomatic and trade ties.

All three countries have reopened their land, sea and air borders and permitted flights to and from Qatar to resume.

UNITED STATES: USCIS Modifies H-1B Selection Process to Prioritize Wages

On 8 January 2021 the Department of Homeland Security (DHS) published a final rule, effective 9 March 2021, amending the regulations governing the process by which US Citizenship and Immigration Services (USCIS) selects H-1B registrations for the filing of H-1B cap-subject petitions. Pursuant to the final rule, USCIS will deviate from the current process of random lottery selection where registrations exceed numerical visa allocations and will instead prioritize the selection of H-1B registrations with higher offered wages based on a wage level ranking.

The wage level ranking will follow the current process of first selecting regular cap cases then advanced degree cases. USCIS will rank and select registrations filed using a revised H-1B cap registration form based on the highest Occupational Employment Statistics (OES) wage level that the proffered wage equals or exceeds for the relevant SOC code in the area of intended employment. This will result in USCIS first selecting petitions for the highest paid workers, then selecting petitions in descending order through the remaining wage levels until the cap has been reached. This may lead to no petitions for entry-level wages being selected given recent historical filing numbers.

USCIS aims to have the new selection process in place by the coming Fiscal Year 2022 cap filing season. However, the final rule is expected to be challenged by the new Biden administration, in court and potentially through legislation. USCIS will most likely continue to use the current regulations during the coming Fiscal Year 2022 cap filing season.

VIETNAM: New Work Permit Decree Published

The new decree 152/2020/ND-CP, issued by MOLISA on 30 December 2020, details the implementation of the labour code on the management of foreign nationals.

This new decree, which takes effect on 15 February 2021, includes the basic implementation guidelines on issuance of Work Permit Work Permit Exemption Certificate, renewals, reissuance and revocation.

The key points of the new Decree 152/2020/ND-CP are as follows:

Qualification documents requirements for experts/specialists and for technicians:

Documents to justify an expert/specialist’s qualification are:

- A bachelor’s degree or higher AND at least 3 years of experience working in a specialized field relevant to the job position the foreign worker is expected to occupy in Vietnam (this remains unchanged from previous decree); OR

- At least 5 years of experience and a “practising” certificate relevant to the job position in Vietnam. The “practising” certificate has yet to be fully defined by the authorities.The former decree 11 allowed either a degree with at least 3 years’ experience OR an expert certificate which could be issued by a company overseas.

Documents to justify a technician’s qualification are:

- A training certificate in the targeted technical specialty OR in another a related specialty for at least one year and have worked for at least three years in the trained specialty (this remains unchanged from previous decree); OR

- At least five years of experience in the job relevant to the job the foreign worker is expected to do in Vietnam. This five years’ experience criteria is a new qualification which is a positive development for those who may not necessarily have a training certificate that can justify their expertise.

Demand for employment of foreign national (Job Position Approval)

The Ministry of Labor, War Invalids and Social Affairs or the provincial People’s Committee have the ability to grant job position approval and shall approve or disapprove the use of a foreign national for each job position within 10 working days from the date of receipt of the written demand. (versus 7 working days in former decree).

Report on the use of foreign employees/assignees

The sponsoring entity shall report twice a year on the use of foreign nationals (previously, the report was quarterly):

- Annually, before July 5, the employer shall make a report on the use of foreign national(s) for the first 6 months of the year (period from 15 December of the previous year to 14 June); AND

- Before 5 January the employer shall make a report on the use of foreign national(s) for the entire year (period from 15 December of the previous year to 14 December).

Investors will only not be required to obtain Work Permit if the entity has reached a minimum capital contribution value of at least 3 billion VND.

Only the owner or stakeholder of a limited liability company or Chairman/member of the board of a Joint Stock Company with a total capital contribution value of at least 3 billion VND will not be required to obtain a work permit.

There remains some clarification needed from the authorities regarding this article.

Short Term assignment for work missions

Foreign nationals coming to Vietnam for short term missions will not be required to obtain a work permit if they come for less than 30 days each time and not exceeding 3 times per year. The former decree didn’t require work permit application for work mission of less than 30 days each stay and not exceeding a cumulative period of 90 days per year with no limitation on the number of entries.

Spouse of Vietnamese nationals

Spouses of Vietnamese nationals are no longer required to obtain a work permit or work permit exemption certificate to work in Vietnam.

Reporting requirement for foreign nationals who are not required to obtain work permit or work permit exemption certificate

The employer/host entity is required to report all foreign nationals who are not required to obtain work permit or work permit exemption to the Ministry of Labor, Invalids and Social Affairs or to the Department of Labor, Invalids and Social Affairs at least 3 days prior to the date the foreign worker is expected to start working in Vietnam.

Additional requirement for foreign national eligible for Work Permit Exemption Certificate

The application dossier for foreign nationals who are eligible for the Work Permit Exemption Certificate must now include a health certificate for work purpose. Previously, the health certificate was not required for the Work Permit Exemption Certificate.

Work Permit application dossier for Managers

The manager category and related qualification documents required for work permit application will be recognized for managers according to the provisions of Clause 24, Article 4 of the Law on Enterprises:

Executive of an enterprise means the owner of a sole proprietorship, a general partner of a partnership, chairperson or member of the Member/Partner Assembly, President of a company, President or member of the Board of Directors, Director/General Director, or holder of another managerial position prescribed in the company’s charter.

Processing time for Work Permit is shorter

Departments of Labor Invalids and Social Affairs shall issue work permit within 5 working days (versus 7 working days in former decree) from the date of receiving a full and valid application dossier.

Work Permit re-issue application

The application dossier for re-issuing a work permit shall now include the Demand for employment of foreign national(s) (Job Position Approval).

Work Permit renewal term

The term of a work permit can be extended only once for a maximum of 2 years. Unfortunately, there is no further detail in the new decree to clarify the crucial question of what the option/process is for the foreign worker at the expiration point of the renewal. It is unknown at this point if the worker may apply for a new work permit or not. There remains an ongoing dialogue between MOLISA and the Vietnam business community to address this article. Previously, renewals were basically allowed indefinitely.

Work Permit termination

The sponsoring entity shall report within 15 days after the work permit is terminated or expired and the Department of Labor, War Invalids and Social Affairs shall issue a written confirmation of the revocation within 05 working days from the day on which the report is received.

MOLISA’s capacity to grant Job Position approval, Work Permit and Work Permit Exemption Certificate

The new decree indicates that demand for the use of foreign national(s) (Job position approval), work permit and Work Permit Exemption Certificate application could also be submitted to the Ministry of Labor Invalids and Social Affairs.

Document required for Work Permit Exemption Certificates

Documents proving that the foreign worker does not require a work permit and Health Certificate, if issued overseas, shall be legalized.

Our Advice

Employers who may be affected by any of these immigration changes are encouraged to contact Newland Chase for case-specific advice.